Context: The increasing integration of renewable resources in power systems increases the needs of the system for flexibility in the form of reserve resources that can rapidly balance fluctuations in system supply. Meanwhile, renewable resources also depress energy prices due to their low marginal cost. This creates a paradoxical effect whereby conventional resources (often with high marginal costs) that are best suited for providing reserve to the system are facing an increasingly lower profit margin. This reflects a shift of value in electricity markets from energy to reserve.

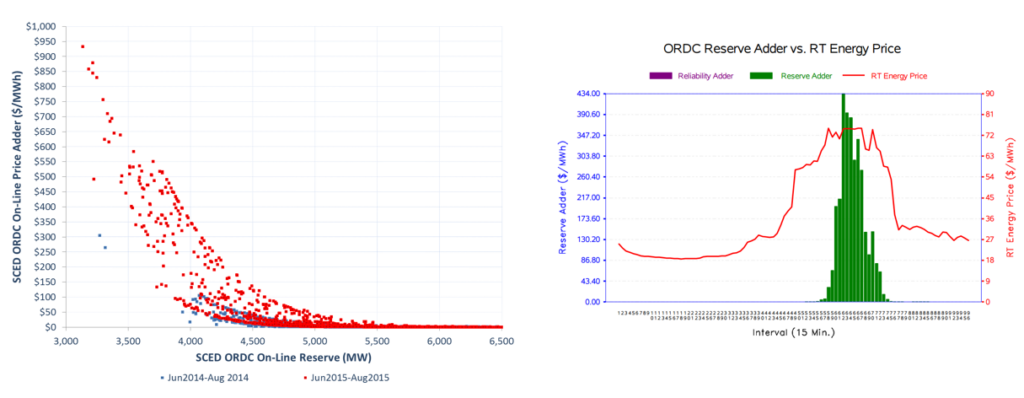

Operating reserve demand curves: The appropriate remuneration of reserves requires the accurate valuation of reserves, in a way that is consistent with system operation practices. Recent research proposes operating reserve demand curves (ORDC) that value increments of reserve capacity as a function of their ability to keep the loss of load probability of the system in check. ORDCs have been introduced in Texas since 2014, and more recently in the PJM Interconnection. The workings of the ORDC are illustrated in the figure below, whereby shortages in reserve capacity induce an increase in the real-time price of reserve (left). Resources that are capable of responding rapidly to these tight conditions receive the real-time energy price (red curve) plus a reserve adder (green). When the system is tight, this reserve adder can be much higher than the marginal cost of the marginal unit, and is a reflection of the fact that the system is under stress. The resources that stand to benefit from this scarcity pricing mechanism are flexibility providers.

EU balancing markets: Recent EU legislation foresees an increasingly important role for scarcity pricing. Recent research has shown that the mechanism can have a material effect on the financial viability of flexibility resources in Belgium. Follow-up analysis has investigated various implementation aspects of scarcity pricing in Belgium, and a market design analysis has modeled the ability of different designs of EU balancing markets to back-propagate scarcity prices to forward energy and reserve markets. Our team has worked with the Belgian regulator and transmission system operator on the development of a scarcity pricing formula for the Belgian balancing market, which has led to the publication of scarcity adders by the Belgian TSO one day after system operation.

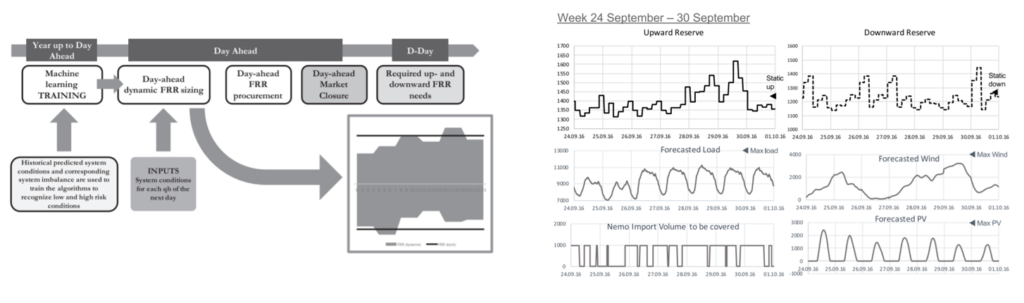

Reserve dimensioning: Apart from procuring reserve at the right price, it is important to also procure the right quantity. Reserve dimensioning is the process that the transmission system operator follows in order to determine how much reserve to procure every day/week/month. More uncertainty implies more need for reserve. In recent work with the Belgian system operator and N-SIDE, we have developed analytics-based methods that are used for adapting the amount of reserve in the system to the foreseen conditions of the following day. The process works as indicated in the figure below (left panel). On a yearly basis, historical data is used for training machine learning algorithms, which use day-ahead information in order to estimate the level of uncertainty in the system in the following day, and adapt the reserve requirements accordingly. For example (right panel), higher wind forecasts imply higher downward reserve requirements, because a higher wind forecast means also a chance of over-forecasting the renewable supply.

Read more

A. Papavasiliou, Scarcity Pricing and the Missing European Market for Real-Time Reserve Capacity, The Electricity Journal, forthcoming

A. Papavasiliou, Y. Smeers, G. de Maere d’Aertrycke, Market Design Considerations for Scarcity Pricing: A Stochastic Equilibrium Framework, The Energy Journal, forthcoming

A. Papavasiliou, Y. Smeers, G. de Maere d’Aertrycke, Study on the general design of a mechanism for the remuneration of reserves in scarcity situations, June 6, 2019

K. De Vos, N. Stevens, O. Devolder, A. Papavasiliou, B. Hebb, J. Matthys-Donnadieu, Dynamic Dimensioning Approach for Operating Reserves: Proof of Concept in Belgium, Energy Policy, vol. 124, pp. 272-285, January 2019

A. Papavasiliou, Y. Smeers, G. Bertrand. An Extended Analysis on the Remuneration of Capacity under Scarcity Conditions. Economics of Energy and Environmental Policy, vol. 7, no. 2, 2018

A. Papavasiliou, Y. Smeers. Remuneration of Flexibility under Conditions of Scarcity: A Case Study of Belgium. The Energy Journal, vol. 38, no. 6, pp. 105-135, 2017